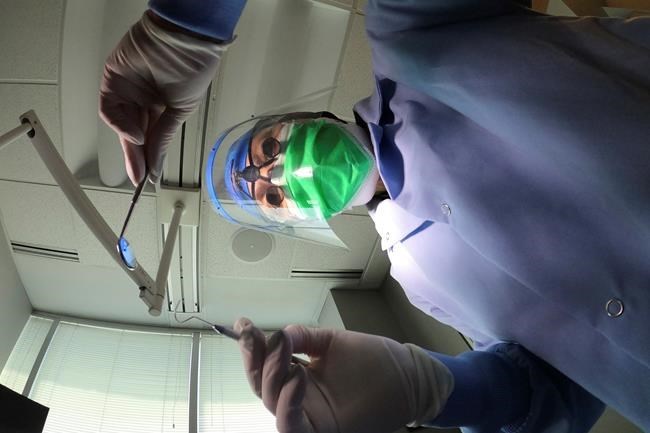

A dentist holds instruments in Skokie, Ill., on Friday, June 12, 2020. The House of Commons standing committee on health voted Monday night to adopt Bill C-31, sending it back to the House for a vote. THE CANADIAN PRESS/AP/Charles Rex Arbogast

Republished October 25, 2022 - 9:30 AM

Original Publication Date October 25, 2022 - 7:51 AM

OTTAWA - The Liberals' proposed dental care benefit is susceptible to fraud if verification measures aren't put in place, Canada's Parliamentary budget officer Yves Giroux warned Tuesday as the legislation is nearing a final vote in the House of Commons.

Giroux was at the Senate Finance Committee to answer questions about the costing analysis of the bill, which proposes a dental care benefit as well as rental support.

The PBO recently estimated that the dental benefit will cost $703 million, while the rental support will cost up to $940 million.

But Giroux told senators that the PBO's analysis did not take into account the potential for fraudulent claims. He warned the overall cost could be higher if the government doesn't take steps to verify the claims are legitimate.

"The potential for fraud will probably be significant so it will depend on strong enforcement and verification measures," Giroux said.

The proposed legislation would only require Canadians to attest that they have received or plan to receive dental services and is not covered by an insurance program.

The bill includes a new dental-care benefit for children under 12 in low- and modest-income families and a one-time $500 allowance for low-income renters.

The Liberals fast-tracked Bill C-31 through the health committee Monday night and is expected to come to a third and final vote in the House of Commons on Thursday.

It also must pass the Senate before it can be implemented.

Both the rent aid and the dental benefit are elements of the supply-and-confidence agreement between the Liberals and the NDP, which saw the Liberals agree to move on some NDP priorities in exchange for that party's support on key votes.

The dental benefit is meant to be an interim measure while the government works on a more complete dental-care program.

Given the benefits will be administered through the Canada Revenue Agency, Giroux also said the government could be doing more to reach Canadians who don't file their taxes but qualify for benefits.

"More and more benefits rely on the tax system," said Giroux. "Yet the government is not as proactive as you would think it would be in 2022, for example, in reaching out to these individuals."

The third plank in the Liberals' plan to help people cope with the rising cost of living was passed last week with the support of all parties, doubling the GST benefit for the next six months.

This report by The Canadian Press was first published Oct. 25, 2022.

News from © The Canadian Press, 2022