Tom Dyas (left) is challenging Mayor Colin Basran in the Oct. 15 election.

(ROB MUNRO / iNFOnews.ca)

October 10, 2022 - 4:49 PM

From their campaign Facebook pages to sparring in debates, the two leading candidates for Mayor of Kelowna are bickering about the facts on two key issues: crime and taxes.

Since they can’t agree on the numbers, we took a closer look at them.

“Kelowna is the crime capital of Canada,” Tom Dyas declared during a Kelowna mayoralty forum Tuesday, Oct. 4, in a statement taken directly from news headlines this year.

“I’m frustrated that we continue to use Kelowna as the crime capital of Canada when it’s clearly not,” Mayor Colin Basran countered. He says Kelowna has the 14th highest crime rate in the province and 54th in Canada.

While neither contention is explained very well, it appears Basran is the one twisting the numbers on crime — sort of.

The problem with crime statistics is how they are tallied and categorized. Statistics Canada, the source of Dyas’ ‘crime capital’ statement, showed earlier this year Kelowna did indeed lead the country in crime statistics, but that number isn’t for Kelowna alone. StatsCan uses a broader definition called Census Metropolitan Area that, for Kelowna, includes the entire Central Okanagan.

Basran is isolating only the city he’s been responsible for, which is fair. But, he’s wrong in saying it ranks number 14th in terms of crime rates in B.C. cities. It actually ranks 17th among B.C. metropolitan police forces in the Statistics Canada data.

Dyas tried to put a different spin on the numbers.

“Comparing smaller Kelowna to other (metropolitan areas) across Canada is like comparing apples to oranges,” Dyas countered in the debate.

Which is not what Basran was doing since his comparison is actually city to city.

Basran is right, therefore, in saying that Kelowna’s crime rate is not the highest in the country when compared to other cities rather than Census Metropolitan Areas.

And, just as a note, the city on its own also has a higher crime rate than the region as a whole. Kelowna’s crime rate in 2021 was 14,363 crimes per 100,000 people versus 11,112 for the region.

What Basran seems to be referring to in his ranking of Kelowna having the 14th highest crime rate is actually data from a different list altogether —the Crime Severity Index which factors in the seriousness of crimes.

Kelowna, on its own, is 14th on that list for municipal forces in B.C. with a rating of 141.9.

The Kelowna Census Metropolitan Area, on the other hand, comes in higher, at 122.3. That makes the region, not the city, the second worst amongst the country’s largest centres for crime severity. But the region still ranks number one for the worst crime rate.

The Statistic Canada data table can be accessed here.

READ MORE: Basran booed at Chamber of Commerce mayoral forum

Another point of contention between the two men is the city’s tax rate.

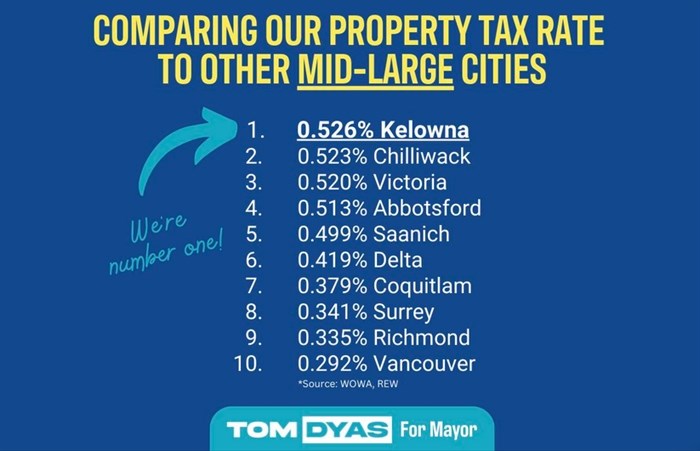

“Comparing our property tax rate to other mid-large cities,” Dyas posted as a headline on his Facebook page, adding in a graph: “We’re number one!”

Image Credit: FACEBOOK/Tom Dyas

That chart shows Kelowna ranked the highest out of 10 B.C. cities with a tax rate of .526%.

He cites WOWA/REW as the source for the information.

WOWA describes itself as “a personal finance encyclopedia for Canadians” and REW is likely Real Estate Weekly.

The WOWA website has a “tax calculator” that gives the tax rate for each city. That is not just the municipal taxes paid, but all others collected by a city, such as police, fire, transit and education, it says. Police and fire costs are generally included in city taxes.

On the 2022 list, Kelowna has the fifth highest rate at .433%.

The WOWA website doesn’t have a link back to the 2021 rate, which may be the number and ranking Dyas is citing.

But, clearly, this data is not City of Kelowna taxes only. It seems to be all taxes collected by the city, which includes the regional district, hospital, schools and more.

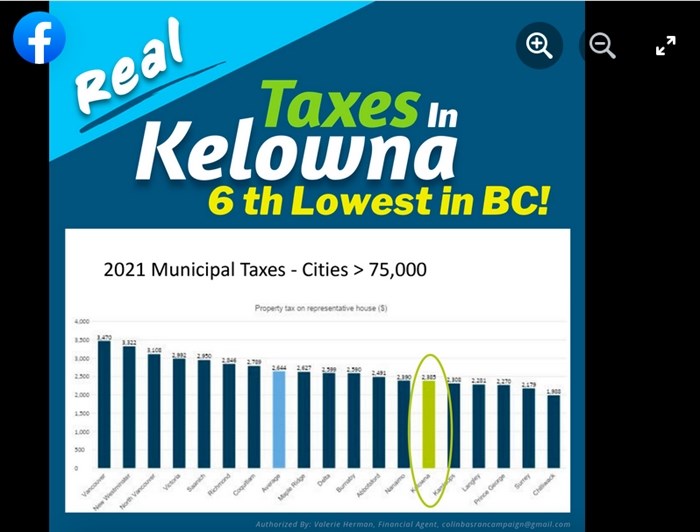

Basran posted a graph on his Facebook page titled: “Real. Taxes in Kelowna. 6th Lowest in B.C.!”

Image Credit: FACEBOOK/Colin Basran

That sits on top of a bar graph showing the property tax paid on a “representative” house in each of 18 cities.

That chart uses 2021 data.

The B.C. government has a data portal that shows, for 2022, Kelowna is the 7th lowest of the 18 cities on Basran's list for “representative” taxes.

But that, too, is not the actual tax rate. The data table does not define “representative” house value but it likely means either the mean or the typical house price in each community.

To find out the actual tax rate, you need to go to the province's posting of taxes in all municipalities that lists the rate per $1,000 of assessed value.

Those numbers are broken down into categories like municipal, school, regional district and hospital. It also separates residential from things like business and industrial.

The residential rate for the city’s share of taxes only, in Kelowna for 2022, is 2.68190.

That gives it the third highest tax rate of the 10 cities on Dyas’ list and fifth on Basran’s list of 18.

The tax rate data can be accessed here.

To contact a reporter for this story, email Rob Munro or call 250-808-0143 or email the editor. You can also submit photos, videos or news tips to the newsroom and be entered to win a monthly prize draw.

We welcome your comments and opinions on our stories but play nice. We won't censor or delete comments unless they contain off-topic statements or links, unnecessary vulgarity, false facts, spam or obviously fake profiles. If you have any concerns about what you see in comments, email the editor in the link above.

News from © iNFOnews, 2022