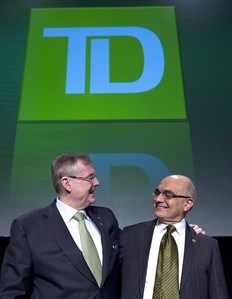

TD Bank former CEO Ed Clark, left, poses with incoming CEO Bharat Masrani in Calgary, on April 3, 2014. THE CANADIAN PRESS/Larry MacDougal

Republished December 04, 2014 - 2:31 PM

Original Publication Date December 04, 2014 - 5:10 AM

TORONTO - TD Bank (TSX:TD) says it's focusing on trimming costs as it predicts that a sluggish global economy, low interest rates and increased competition will make for a challenging 2015.

"We face several headwinds," chief executive Bharat Masrani told investors during a conference call as the bank reported its latest earnings Thursday. "The operating environment remains difficult, with interest rates still low, a global economy that's only gradually taking hold and increased competition from traditional and non-traditional players."

TD Bank's results fell shy of expectations, despite the fact that the bank increased its fourth quarter profit to $1.746 billion of net income, or 91 cents per share, from $1.616 billion or 84 cents per share a year earlier. The bank also increased provisions for credit losses and other expense items.

On an adjusted basis, profits grew to $1.862 billion or 98 cents per share, from $1.815 billion or 95 cents per share a year earlier.

Analysts were expecting $1.05 per share of adjusted earnings and $1 per share of net income, according to data compiled by Thomson Reuters.

TD's Canadian retail and its wholesale banking operations both saw increases from last year while its U.S. retail operation was relatively unchanged.

Citi analyst Stefan Nedialkov said TD Bank managed to "buck the trend" of weaker than expected investment and corporate banking revenues that has dominated the earnings reports of Canada's other top lenders this week.

"Canadian retail resilience should be echoed in Scotia's results tomorrow," Nedialkov said in a note.

The bank's revenue increased by $452 million from a year earlier to $7.452 billion — well above the estimate of $7.01 billion.

The quarter included $54 million of integration charges related to its acquisition of MBNA Canada's credit card portfolio, which reduced earnings by three cents per share — compared with a penny a year earlier. Amortization of intangibles also reduced its profit by four cents per share, compared with three cents per share a year earlier.

TD also increased its provision for credit losses by $19 million to $371 million, from a relatively low $352 million.

"Almost everything that one does not want to see at TD came through in the quarter," Barclays analyst John Aiken wrote in a commentary.

"Considering we had anticipated that TD's relative exposures would result in relatively more positive earnings than peers, the fourth quarter is a decidedly negative surprise."

It is planning to invest in developing digital payment technologies, an area where there is "intense interest," Masrani said.

"You have potential entrants that are not banks in that space and that's an important business for TD, for the Canadian banks, and we've got to figure out a ways to how we compete with those players, how can we be as agile, as flexible as them."

Masrani officially became TD's top executive after the 2014 financial year ended Oct. 31 but he had been named in April 2013 as the successor of Ed Clark, who retired effective Nov. 1 this year.

For the full 2014 financial year ended Oct. 31, TD had $29.96 billion of revenue — up $2.7 billion from 2013 — while net income rose by $1.2 billion to $7.88 billion and adjusted profit increased about $900 million to $8.12 billion.

TD's next Jan. 31 dividend payment will be 47 cents per common share, which is unchanged.

In the fourth quarter, TD's Canadian retail banking operations had $4.92 billion of revenue — up $400 million from a year earlier, while net income increased $67 million to $1.3 billion. Its U.S. retail banking operations generated $2.05 billion of revenue, up from $1.96 billion in the 2013 fourth quarter, and $509 million of net income, up from $448 million.

TD's wholesale banking arm had $604 million of revenue — little changed from $603 million a year earlier — but its net income rose $38 million to $160 million — an increase of 31 per cent.

Follow @alexposadzki on Twitter.

News from © The Canadian Press, 2014