Image Credit: Data collected by Brendan Kergin

October 25, 2016 - 9:00 PM

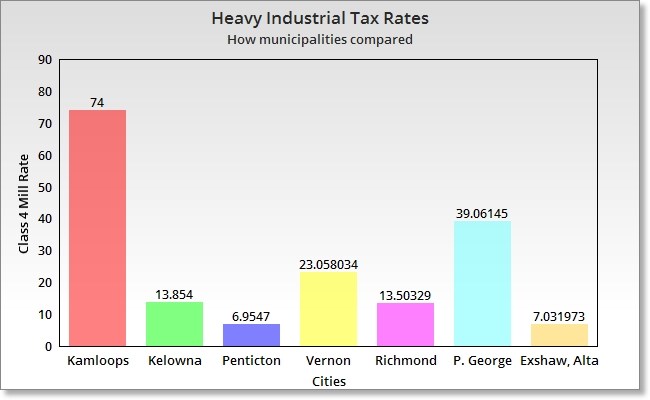

KAMLOOPS - Tax rates in the City of Kamloops came under fire again last week when Lafarge announced that it was closing its cement plant and laying off dozens of workers. A quick comparison of cities in the Okanagan, Interior and other cities Lafarge operates in appears to confirm its concerns.

For years, major industry companies in Kamloops have complained the municipal tax rate on major industries, currently at 74, is too high, and according our research, that complaint may carry some water because rates in comparable cites are, in some cases, more than 60 points lower.

All municipalities in B.C. have nine tax classes. Class four is major industry, for businesses like mills, mines and cement plants.

Lafarge owns three plants in western Canada. While the one in Kamloops is shutting down for now, the two still operating are in Richmond and Exshaw, Alberta. Richmond has a municipal class four tax rate of 13.5 (82 per cent lower), while Exshaw, which follows Alberta tax rates, has a non-residential rate of about seven (90 per cent lower). Last year, Lafarge paid $538,000 in taxes to Kamloops.

Kamloops doesn't stack up well to similar communities in the region, either. The closest is Prince George, currently at 39.1. In the Thompson-Okanagan area, Penticton is at seven, Kelowna at 13.8 and Vernon is at 23.1. However, neither Penticton nor Vernon currently have any businesses paying those rates, while Kelowna has only one, Tolko. The City of Vancouver’s is also lower, at 41.9.

File Photo: Domtar Mill, Kamloops

(BRENDAN KERGIN / iNFOnews.ca)

Kamloops’s used to be higher, at 78.7, where it was frozen from for a few years.

Rather than lower taxes in any meaningful way, Kamloops has been trying to add more heavy industrial companies to the pool. It's only proposed solution is ongoing attempts to annex the nearby New Afton Gold mine to add to tax revenue. Neither the mine or the proposed Ajax Mine location are inside city boundaries, so no municipal taxes are collected.

All tax rates listed are municipal only, and have additional taxes on top of them which are about equal. When things like regional district or school taxes are added, most rates raise five to eight points, though Prince George jumps from 39 to 52.2. In Kamloops it moves to 82.7.

The tax rate, or mil rate, is calculated using the assessed value of property in a city and the amount of money the city needs to raise through taxes to equal its budget. Lowering one class rate means other classes will likely have to make up for it to balance the budget.

To calculate tax bills, the assessed value of a property is multiplied by the tax rate associated with the property's use.

City of Kamloops financial director, Kathy Humphrey, has pointed to assessed property values as having a big impact on the actual amount paid by businesses. Cities with higher property value assessments could mean that while they have a lower tax rate, similar businesses may pay similar dollar amounts.

To contact a reporter for this story, email Brendan Kergin or call 250-819-6089 or email the editor. You can also submit photos, videos or news tips to the newsroom and be entered to win a monthly prize draw.

We welcome your comments and opinions on our stories but play nice. We won't censor or delete comments unless they contain off-topic statements or links, unnecessary vulgarity, false facts, spam or obviously fake profiles. If you have any concerns about what you see in comments, email the editor in the link above.

News from © iNFOnews, 2016