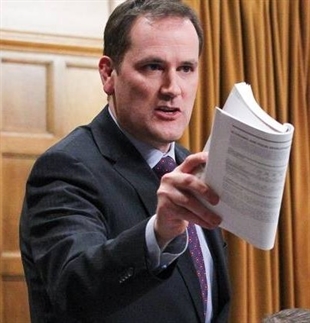

Dan Albas a Member of Parliament.

Image Credit: SUBMITTED/Dan Albas

November 11, 2017 - 12:00 PM

OPINION

The major issue reverberating around Ottawa this week was the recent release of the 'Paradise Papers'.

For those of you unfamiliar with the 'Paradise Papers,' they are leaked documents that contain the names of individuals who have involvement in offshore accounts that in some cases are used to avoid paying domestic taxes.

The reason this has become a political issue in Ottawa is that one of the names on the list happens to be the Liberal Party of Canada's chief fundraiser.

This same individual accompanied the Prime Minister to an exclusive dinner at the White House during the Obama administration. This in turn raised the question why a Liberal Party fundraiser was brought to an exclusive dinner when the Liberal Government's Natural Resource Minister was left off the guest list.

To date the Prime Minister has refused to answer this question.

From my perspective, I think it is important to recognize that being named on the Paradise Papers is not indicative of having done anything illegal. The real issue is, we have observed the Canada Revenue Agency attempt to tax employee discounts. At the same time the Liberal Government attempted a large tax grab against farmers and small business owners.

Meanwhile, individuals of immense wealth can utilize offshore accounts and family trusts here at home with no proposed taxation change whatsoever.

In many ways this creates two tiers of taxation where the wealthiest are treated differently by this Liberal government then everyday Canadians.

This raises a question on exactly how much potential tax revenue is lost by these types of tax policies. Officially this is known as the “tax gap”. The tax gap is the Government's potential tax revenue as opposed to the amount of tax revenue it is actually able to collect.

In the United States this type of taxation data has been tracked and publicly disclosed for many years.

As the recent release of the Paradise Papers has brought the extent of this problem to light, many have questioned what the tax gap is in Canada.

Unfortunately, the Canada Revenue Agency refuses to disclose this information. In fact, there has been considerable effort in Parliament by MP's and Senators alike to obtain this information. To date, there has been no success. Considering that some estimates believe Canada’s tax gap could be as high as $47 Billion annually, this is a serious and growing concern.

The Liberal Government has justified the position of the Canada Revenue Agency, arguing that Canadians tax information is confidential and as a result this aggregated data should not be publicly released. The Liberals have also pointed out they are increasing the budget for the Canada Revenue Agency for enforcement and investigation purposes.

My question this week: do you believe that Canada Revenue Agency should join countries such as the United States, Sweden, Australia and others in publicly disclosing the tax gap?

I can be reached at Dan.Albas@parl.gc.ca or call toll free at 1-800-665-8711.

We welcome your comments and opinions on our stories but play nice. We won't censor or delete comments unless they contain off-topic statements or links, unnecessary vulgarity, false facts, spam or obviously fake profiles. If you have any concerns about what you see in comments, email the editor.

News from © iNFOnews, 2017