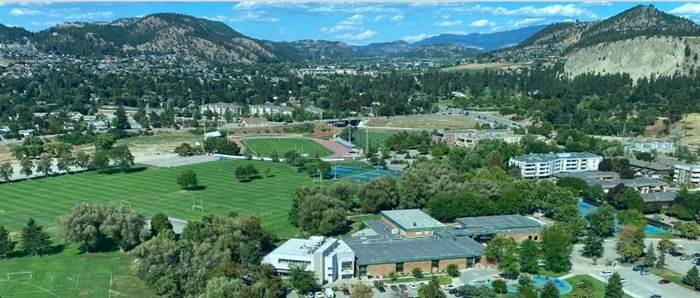

Parkinson Recreation Centre.

Image Credit: Submitted/City of Kelowna

October 02, 2023 - 8:00 AM

Opponents cite numerous reasons to sign petitions against a $241.3 million loan to build and expand recreation facilities in Kelowna.

First off, they don’t like the idea of it not going to a vote. Instead, 12,160 people have to submit petitions against it by Oct. 13 using the alternative approval process.

Some say it’s simply too expensive or in the wrong place.

READ MORE: Opponents of Kelowna's Parkinson Recreation Centre battling 'loophole'

They also choke at the huge cost – $15 million a year to service the debt for 30 years – and suggest the city isn’t really telling the truth about the total cost of the $287.5 million plan to rebuild Parkinson Recreation Centre ($242 million) and upgrade other facilities at a total cost of $287.5 million.

“Indeed, with the need to borrow over $240 million, the Parkinson Recreation Centre renewal project is expected to eventually cost at least $450 million in capital and interest, as estimated by Ms. Amy Johnston, the project architect,” resident GC Gavrel said in an email to the mayor and council, copied to the media.

“Ms. Johnston further explains that the repayment of that debt will be done over a period of 30 years at a cost of $15 million per year, of which $10.2 million will come from increases in the property taxes and the rest from as-yet undetermined sources.”

The Kelowna Concerned Residents for Financial Accountability is even more blunt.

“The City has been extremely vague, admitting even that the buildings have not been designed, and lots of things can change,” it says on its website. “At the same time, the City asserts that the entire initiative, including the $241.3 million loan, will have only minimal impact on our taxes. It declines to provide proof.”

In some ways, the criticism is valid.

The city’s Growing Active Communities webpage shows “debt impact” growing to $10.2 million by 2029.

But, it says, taxes won’t go up by more than 1.25% in any given year to get to that level.

It doesn’t mention the $15 million annual cost of repaying the loan so, since the project architect for the City of Kelowna, has put that out there, it only makes sense to explain how it all works.

But, rather than “declining to provide proof,” the proof was actually published months ago. It’s just that it’s in a report that went to the May 15 city council meeting, while it is linked on that page, it is very hard to find. It is near the bottom of that page, under links, called 'Building a Stronger Kelowna - Funding Strategy (may 2023).'

“There’s a couple of complexities that I think folks are, perhaps, missing in their understanding of the financial arrangements,” Joe Sass, chief financial officer for the city, told iNFOnews.ca.

First up is the fact that, starting this year, the city added 1% to the tax base, taking in $828,000 a year to pay down the coming debt. Sort of.

“It was approved as part of the 2023 budget, reflecting the need to invest in recreation, but that isn’t necessarily tied to this,” Sass said. “It would be used for this if it’s successful but it’s not cash flow for the project yet. We haven’t actually spent any money on the project yet.”

That may be but that 1% is now in the tax base so when taxes go up by 0.16% next year to start repaying the loan, that is more like a 1.16% increase going to recreation in 2024 versus 2022.

On average, over the next five years, taxes for recreation will go up $20 per year so by 2029, the average homeowner will be paying $100 more than they did this year.

The 1% increase added to this year’s taxes is not counted in that $100.

Another complicating factor is that the $241.3 million loan won’t be taken all at once. Rather, $73.3 million is slated to be borrowed in 2024. The annual amounts drawn out gradually decline to $41.1 million in 2027.

That means the $15 million annual repayment amount will not be reached until 2028. The annual new taxes won’t reach the $10.2 million level until 2029.

The tax calculations are also based on the reality that Kelowna is a growing city so there will be more people and more businesses paying more taxes each year.

READ MORE: Kelowna wants to spend nearly $300M on recreation facilities including Parkinson rebuild

Still, where does the other $5 million in annual payments come from?

There are three sources listed in the May 15 report.

First up is the Kelowna Legacy Fund, which holds more than $110 million in FortisBC shares as the result of selling off the city’s electrical utility and gas rights-of-way to Fortis back in 2013 and 2015.

READ MORE: Why Kelowna isn't spending its $100 million legacy fund

That’s now set up to generate at least $4 million a year in “distributable funds.” Starting in 2025, $4 million of the “missing” $5 million to pay the loan will come from the Legacy Fund.

Another $828,000 comes from that 1% tax increase added this year.

Finally, the balance of $13 million comes out of a provincial government Growing Communities Fund already sitting in the city's bank.

Most of that, $9.7 million, will be used to pay directly for project costs starting next year. The rest will go to debt payments in 2026-28. After that, the tax increases will cover the debt payment.

Of course, there are some unknowns here.

The money is borrowed through the Municipal Finance Authority so it’s at a better rate than a regular mortgage.

But if interest rates continue to climb, the rate charged to the city may climb when money is taken in future years.

That should be offset by the fact that, if interest rates go up, the city’s investment returns will also go up since they are tied mostly to fixed income investments, like bonds.

That means the Legacy Fund and money invested from the Growing Communities Fund will also grow.

Another unknown is the final cost of the projects, which have yet to be designed but could also be hit by inflationary pressures and run over budget.

“There’s always that risk (going over budget),” Sass said. “We would fund it. We may borrow, but we couldn’t borrow under this bylaw. There’s a great deal of confidence, given the procurement method that we’re using that brings all the proponents together, so there is some confidence that we will be able to manage cost escalations over time.”

Construction inflation these days is in flux, with some aspects going up in price and others coming down so it is very hard to predict costs two or three years out, he said.

The projected cost of the Parkinson Recreation Centre has grown by leaps and bounds from an original projection a decade ago of about $50 million to $242 million now.

“Inflation is a challenge but that’s got to be balanced against our need to bring infrastructure in to manage the growing community,” Sass said. “In my professional bean counter opinion, I would stress that not building things does not absolve you from inflation. That’s not a reasonable solution to handle your inflationary pressure by just not building things.”

The May 15 report to council was item 5.1 on the PM meeting agenda, here.

— This article was updated at 5 p.m. on Oct. 3, 2021, to clarify there is a link on the Growing Active Communities website to the city's funding strategy but it's hard to find.

To contact a reporter for this story, email Rob Munro or call 250-808-0143 or email the editor. You can also submit photos, videos or news tips to the newsroom and be entered to win a monthly prize draw.

We welcome your comments and opinions on our stories but play nice. We won't censor or delete comments unless they contain off-topic statements or links, unnecessary vulgarity, false facts, spam or obviously fake profiles. If you have any concerns about what you see in comments, email the editor in the link above. SUBSCRIBE to our awesome newsletter here.

News from © iNFOnews, 2023