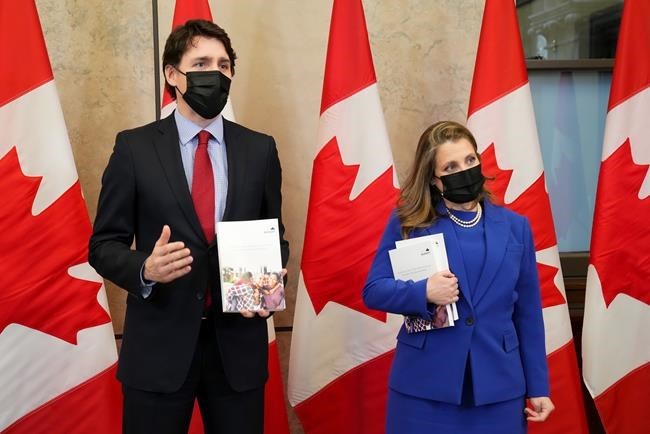

Finance Minister and Deputy Prime Minister Chrystia Freeland and Prime Minister Justin Trudeau speak with members of the media before the release of the federal budget, on Parliament Hill, in Ottawa, Thursday, April 7, 2022. Ottawa has unveiled a tax credit worth $2.6 billion over five years to help Canada’s energy sector invest in carbon capture and storage technology. THE CANADIAN PRESS/Sean Kilpatrick

Republished April 07, 2022 - 4:13 PM

Original Publication Date April 07, 2022 - 1:26 PM

CALGARY - Ottawa is urging oil and gas companies to move quickly to take advantage of a major new tax credit for carbon capture and storage — a pricey technology that proponents say could play an important role in reducing this country's greenhouse gas emissions.

In the federal budget announced Thursday, the Liberal government said it will allocate $2.6 billion over five years to a tax credit for companies investing in projects that employ the technology, which traps greenhouse gas emissions from industrial sources and stores them deep in the ground to prevent them from being released into the atmosphere.

Starting in 2022, companies will be able to claim a tax credit of up to 60 per cent for direct air capture projects and 50 per cent for all other eligible carbon capture projects. A 37.5 per cent tax credit is available for investment in equipment for carbon transportation, storage and use. (Enhanced oil recovery, which involves injecting carbon underground to extract more oil from older wells, is excluded from the tax credit.)

The government will decrease the tax credit rates by 50 per cent in 2031 in an effort to get companies to build their carbon capture projects now, not later.

Kent Fellows, an assistant professor of economics with the University of Calgary's School of Public Policy, said it's clear that Ottawa wants the needle to move.

"It's potentially a lot of money, and especially very quickly," Fellows said of the tax credit. "They (the government) are looking for this to happen quickly. They're looking for companies to get up off the couch, and actually get these proposals moving."

Canadian oil and gas companies have reported record profits in recent months due to soaring commodity prices. But while many companies have proposed investing in carbon capture as a way to reach their emissions reduction goals, most projects are still in the development phase.

The industry has said the large-scale buildout of carbon capture and storage in Canada will be contingent on government help. Energy producers had lobbied for a carbon capture tax credit to cover up to 75 per cent of the capital costs of investing in the expensive technology.

Some of the companies that have proposed carbon capture and storage projects include Enbridge Inc., Atco Ltd., and Capital Power. In addition, the Oil Sands Pathways to Net Zero initiative — an alliance of Canadian Natural Resources Ltd., Cenovus Energy Inc., ConocoPhillips, Imperial Oil Ltd., MEG Energy Corp., and Suncor Energy Inc — has proposed a major carbon capture and storage transportation line that would capture CO2 from oilsands facilities and transport it to a storage facility near Cold Lake, Alta.

That project alone could deliver about 10 million tonnes of emissions reductions per year and could be up and running by the end of the decade, according to the oilsands group.

“With this announcement, the federal government has recognized the importance of developing new technologies to help Canada fight climate change, as well as the importance of the oilsands to our country’s energy security," said Kendall Dilling, interim director of the Pathways to Net Zero Alliance, in a release Thursday.

“Because of the amount of long-term capital investment required to build carbon capture and storage infrastructure, and the speed we need to move at to meet 2030 targets, the countries that are doing this successfully are all using a collaborative model where governments are co-investing alongside industry," Dilling added.

Proponents say Canada can’t meet its climate goals without vastly expanding the use of carbon capture and storage technology. The government's recently released Emissions Reduction Plan envisions total emissions from the oil and gas sector — including production, refining and transportation via pipelines — falling to 110 million tonnes by 2030, down from 191 million tonnes in 2019.

"The International Energy Agency has determined that in order for the world to reach net zero, carbon capture and storage technologies are one of the tools in the tool box," said Mark Zacharias, special adviser to the B.C.-based think tank Clean Energy Canada.

"This (carbon capture) could be transformational," said Martha Hall Findlay, chief climate officer for Suncor. "Canada has had trouble meeting its emissions reductions targets ... and this could take us from having trouble meeting our targets to being a global leader in emissions reduction."

However, some environmentalists argue that offering a tax credit to oil and gas producers is akin to subsidizing fossil fuel production.

"Carbon capture is not a climate solution, it's a greenwashing strategy," said Julia Levin of Environmental Defence. "Instead of creating yet another fossil fuel subsidy, the government should have invested in proven climate solutions, including renewable energy, efficient affordable housing and electrification of transportation."

In late March, the government of Alberta selected six proposals from companies interested in developing what would be Canada’s first carbon storage and sequestration hubs, in the Edmonton region. The proposals selected were put forward by Enbridge Inc., Shell Canada, Wolf Midstream, Bison Low Carbon Ventures, Enhance Energy and a joint-venture project from TC Energy and Pembina Pipeline Corp.

Also in Thursday’s budget, the federal government announced a new 30 per cent tax credit for exploration projects related to critical minerals such as lithium and cobalt, which are used in the production of electric cars and batteries.

This report by The Canadian Press was first published April 7, 2022.

News from © The Canadian Press, 2022