FILE PHOTO

Image Credit: UNSPLASH/Razvan Chisu

January 08, 2023 - 1:00 PM

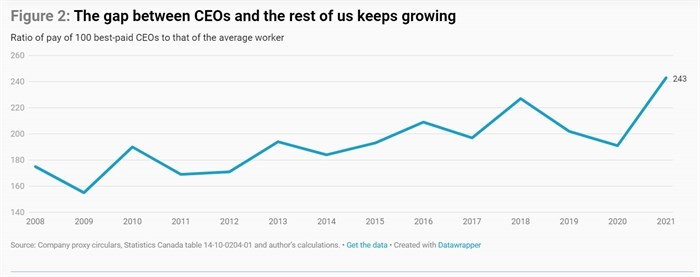

The average pay of Canada’s top 100 CEOs hit an all-time high in 2021, making the wage gap between CEOs and workers bigger than it’s ever been, according to a new report.

The highest-paid CEOs broke every compensation record on the books in 2021, the Canadian Centre for Policy Alternatives’ (CCPA) annual report on CEO pay reveals.

Average pay was $14.3 million, compared to the previous record of $11.8 million in 2018. That year, the top 100 CEOs earned 227 times more than the average Canadian worker.

Line graph illustrating the ratio of pay of the top 100 Canadian CEOs to the average Canadian worker. The current record is 243 times the average workers' pay in 2021, beating the 2018 record of 227 times. The year with the third-biggest disparity was 2016, with 209 times.

Image Credit: SUBMITTED

Unlike the average worker, a CEO’s earnings are largely the result of bonuses and stock options, sometimes referred to as “variable compensation.” This pay structure accounted for 83 per cent of the top 100 CEOs’ total earnings in 2021.

Variable compensation is performance-based, so a CEO’s pay will be tied to the success of their company; that wouldn’t be the case if they only received a salary. But the bonus structure can be changed after the fact to ensure it results in a large bonus, David Macdonald, senior economist with the CCPA and author of the report, told Canada’s National Observer.

The CCPA’s numbers for 2020 — the second-best year ever for CEO compensation — revealed CEOs’ earnings were largely sheltered from the economic impacts of the COVID-19 pandemic. Thirty of the top 100 CEOs received the Canada Emergency Wage Subsidy, 14 had their bonus structure changed to protect them from the pandemic’s impacts and another five got both, according to last year’s report.

“The last two years really exemplify the problem with CEO pay,” said Macdonald. “It's really a pay-for-luck scheme, but only good luck.”

While households and workers suffer in times of high inflation, companies raise their prices and the resulting record-high corporate profits pad the pockets of CEOs, said Macdonald.

Philip Fayer, CEO of Nuvei, an online payment processing company, raked in almost $141 million in 2021, making him the highest-paid CEO that year. Trailing behind Fayer are Patrick Dovigi of GFL Environmental Inc. and Joseph C. Papa of Bausch Health Companies Inc. with roughly $43 million and nearly $29 million, respectively. Only three of the top 100 CEOs are women, according to the report.

It’s “maddening” that the richest CEOs’ pay reached an all-time high “while inflation continued to erode wages of regular Canadians,” Green MP Mike Morrice told Canada’s National Observer in an emailed statement.

“We can’t just scratch our heads as we see our health-care system eroding, and people with disabilities being told to consider MAiD (medical assistance in dying) in place of providing a basic income for a dignified life,” said Morrice.

“Enough is enough, we need to rein in this massive inequality … the 2022 numbers will only be worse.”

The report recommends implementing higher top marginal tax brackets and a wealth tax, among other things, to curtail the growing income inequality. While the NDP has long pushed for a one per cent tax on wealth over $20 million, the federal government has given no indication a wealth tax is in the cards.

In July 2021, the federal government introduced a law to limit a loophole where people are only required to pay tax on half the value of stock options they’re given as compensation.

“You still get the half-off coupon on the first $200,000, which is a bit ridiculous; it should be zero,” said Macdonald. However, he says this law “should certainly be seen as a win” because very few people except for CEOs and top executives are paid in this way.

In a similar vein, the report says the capital gains inclusion rate should be raised to 100 per cent, meaning when people — often CEOs and executives — receive shares as compensation and those shares grow in value over time, the full value should be taxed. Currently, only half of the income from those capital gains is counted towards the calculation of income taxes.

It also recommends limiting corporate deductibility of compensation over $1 million so companies can’t deduct the CEOs' “outrageous compensation” from their taxes as a cost of doing business.

“The federal government is ensuring the wealthiest Canadians pay their fair share, including big banks and the wealthiest among us,” a Department of Finance official said in an emailed statement to Canada’s National Observer.

The 2022 fall economic statement announced the government’s intention to introduce a corporate-level two per cent tax on share buybacks, which would come into force on Jan. 1, 2024. This measure would increase federal revenues by $2.1 billion over five years, according to the fiscal update.

This measure is not directly correlated with CEO pay, said Macdonald.

The fall fiscal update also reaffirmed the government’s intent, stated in Budget 2022, to re-examine “a new minimum tax regime to ensure that all wealthy Canadians pay their fair share of tax.”

The federal NDP did not respond to a request for comment by deadline.

— This story was originally published by Canada's National Observer.

News from © iNFOnews, 2023