Image Credit: ADOBE STOCK

September 03, 2020 - 7:30 PM

With fewer car accidents in Canada during the COVID-19 pandemic, insurance companies are saving money, but British Columbians aren’t seeing many benefits.

Compared to last year, B.C. has saved the most on auto insurance, with an estimated 64 per cent decrease in claims from March 15 to June 16 in 2019 compared to the same timeframe this year, according to Hellosafe.ca.

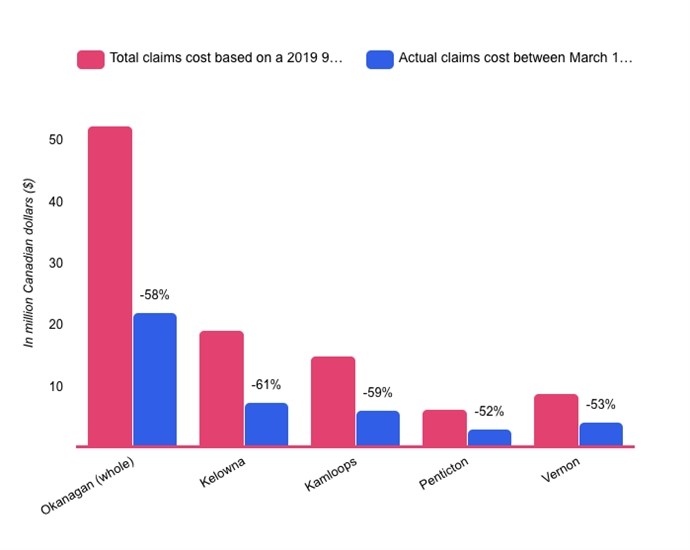

In the Okanagan, auto claims have decreased roughly 58 per cent between March 15 to June 16 of last year, and the agency estimates that insurers are saving roughly $30 million in that timeframe compared to 2019. In Kelowna, claims decreased by 61 per cent, in Kamloops claims dropped by 59 per cent, Vernon's decreased by 53 per cent and Penticton dropped by 52 per cent. Hellosafe.ca notes that these numbers are estimates based on demographics and numbers provided by insurance agencies.

Image Credit: Hellosafe.ca

Hellosafe.ca reports the country’s insurance agencies have saved roughly $2.8 billion overall during the pandemic because of COVID-19 restrictions changing driving habits. Private insurance companies have returned roughly $280 per driver in auto insurance premiums relief, with the exception of B.C. Insurance companies may have returned $775 million to customers, but are still saving $2.7 billion during the pandemic.

READ MORE: Think twice before deferring your debt, bill payments during COVID-19 crisis

ICBC has the most expensive insurance of any province in the country and also did not offer returns in premium relief. The average annual car premium is $1,832, Hellosafe.ca said. ICBC did waive some small fees and allowed customers to defer payments during the pandemic.

ICBC is reporting that it experienced an investment loss during the COVID-19 pandemic, according to finance minister Carole James, in a press release.

B.C.'s fiscal year ended with a deficit of $321 million, which is $595 million lower than the surplus projected in Budget 2019, mainly due to: costs related to B.C.’s initial COVID-19 response, such as public health measures; lower taxation revenue due to COVID-19 and a $298-million ICBC investment loss due to market conditions from COVID-19, according to the province's press release.

Canada-wide there has been a 54 per cent decrease in car accidents and a 55 per cent decrease in car-related insurance claims, Hellosafe.ca said.

“With the pandemic starting over again in August, the situation may change soon, with potentially additional refunds expected by policyholders,” the company said.

To contact a reporter for this story, email Carli Berry or call 250-864-7494 or email the editor. You can also submit photos, videos or news tips to the newsroom and be entered to win a monthly prize draw.

We welcome your comments and opinions on our stories but play nice. We won't censor or delete comments unless they contain off-topic statements or links, unnecessary vulgarity, false facts, spam or obviously fake profiles. If you have any concerns about what you see in comments, email the editor in the link above.

News from © iNFOnews, 2020