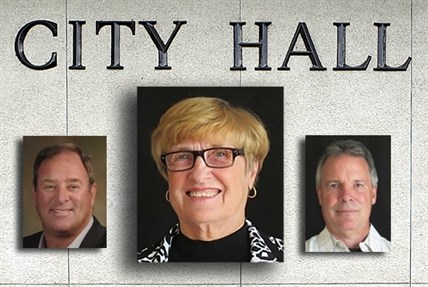

Carol Gran (centre), Dale Olson (right) and Graeme James (left) have announced they will run together November 15. Gran says their primary mandate will be to pass a bylaw prohibiting any tax increases for four years.

(ADAM PROSKIW / iNFOnews.ca)

September 15, 2014 - 10:15 AM

KELOWNA – Carol Gran, a candidate in a new political slate promising zero per cent tax increases for the next four years, served on council during the largest municipal tax increase in Kelowna's recent history.

Gran said in a press release, if elected, the first order of business for the slate of three, including Dale Olson and Graeme James, will be to introduce a bylaw prohibiting property tax increases for the next four years. But during her only term on council, taxes were significantly higher than the years before or since.

From her time in office between 2005 and 2008, tax rates jumped to an average of 3.1 per cent from 1.8 per cent for 2000 to 2004. The average annual tax increase since she left office is 2.35 per cent.

The biggest increase in the last 20 years, 5.66 per cent in 2008, also happened during Gran’s tenure on council and was needed to pay for exactly the type of large-scale public project Gran says the city should be avoiding. The H20 Centre, on which Gran served as committee member alongside councillors Andre Blanleil and Barrie Clark, was also approved during Gran’s term.

Outgoing Mayor Walter Gray takes issue with the zero per cent tax policy, saying it simply won’t work and takes Kelowna in the wrong direction.

“When you are at zero (per cent) you are effectively going backward,” he says. “Everything else around you is going up and you end up falling behind.”

He points to Vernon as an example of a city that recently attempted a zero per cent increase.

“Vernon still has not recovered from that false economy of thinking they can run at zero per cent,” he says. “They used up all of their cash resources so they had no slush fund, they sold off real estate and they reduced the number of RCMP. At some point it catches up with you and you are in a position where you have to work your way back up to a surplus.”

He adds that the experiment is a major reason Vernon struggled more than Kelowna through the 2003 recession.

“They had no buffer to get them through tough times,” he says.

Minutes from the May 5, 2008 meeting when the budget was approved show Gran as absent.

“She had a habit of being absent a lot,” Gray says, adding that an absence during a vote counts neither for or against.

The slate also said they want referendums on important issues rather than the currently employed alternate approval process.

The website set up by the slate, calling themselves Taxpayers First, says: “The alternate method currently used by Kelowna puts the onus on the public to come to City Hall and sign the petition, which is cumbersome and quite frankly unfair. Councils know that there is guaranteed success for their petition whereas a referendum at election time means greater scrutiny and transparency. The onus is then on City Council to do a better job of informing the public.”

Gray says it’s ironic that a group advocating a zero per cent increase would also advocate for a referendum.

“A referendum would cost taxpayers between $80,000 and $100,000,” he says. “That money would then not be available for things like sidewalk repair and other things our citizens need. People (who) are against the (alternate approval process) fundamentally believe that a person who is against something shouldn’t have to work hard to convince the city that their decision is wrong.”

Of the city’s $400-million dollar annual budget, approximately $100 million comes from property taxes.

To contact the reporter for this story, email Adam Proskiw at aproskiw@infotelnews.ca or call 250-718-0428. To contact the editor, email mjones@infotelnews.ca or call 250-718-2724.

News from © iNFOnews, 2014