FILE PHOTO - Penticton city council will deliberate a proposed 8.5% tax hike at public meeting scheduled for Nov. 22 and 23, 2021.

(STEVE ARSTAD / iNFOnews.ca)

November 09, 2021 - 7:00 PM

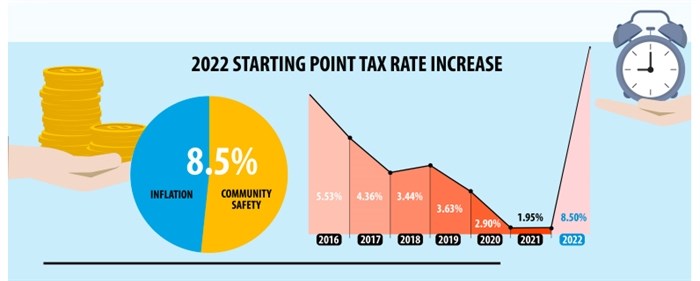

The cost of keeping the streets safe combined with inflation will result in an 8.5% property tax increase for Penticton if council doesn’t tweak the proposed budget during public debates later this month.

That amounts to increases of $185 a year for homeowners and $1,359 for businesses, according to the city's draft financial plan. Those figures are based on an average home worth $469,909 and an average business worth $1,118,696.

The tax increase could be mitigated by cutting services within the city, but during a media briefing Monday, Nov. 8, general manager of finance Jim Bauer said the city learned that service reduction is not a popular idea after consulting the public.

Dipping into reserve funds is an option, Bauer said, but warned that it is not a sustainable revenue stream and needs to be done thoughtfully.

READ MORE: Penticton city budget takes a $3.6 million hit to pandemic

Council will debate the budget during meetings on Nov. 22 and 23, which will be open to the public.

Bauer said a major priority of focus for this year’s budget is community safety. The proposed budget would allow for the creation of 12 new positions, 11 of which are in community safety, the other position is in information technology.

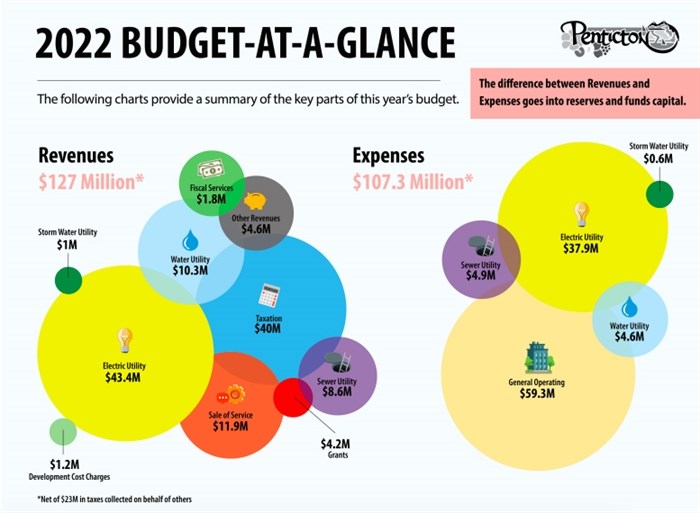

An infographic illustrating the size of revenues and expenses in the City of Penticton

Image Credit: www.penticton.ca

There is a total of $127 million in revenue and $107.3 million in expenses. The biggest portions of revenue come from the electrical utility at $43.3 million and taxation at $40 million.

The largest among the $107.3 million of expenses are the general operating costs of $59.3 million, and the electrical utility at $37.9 million. The largest cost included in general expenses is $12.8 million for the RCMP.

The city budgeted for 48 RCMP officers in the last fiscal year, 52 for the current year, and next year’s budget proposes enough spending for 55 officers. Beyond more police officers, community safety also includes spending for firehall upgrades and more bylaw officers.

For every percentage of tax increase the city generates $358,000 in revenue, and it attributes more than half of the 8.5% raise to community safety.

A timeline of tax rate increases in Penticton.

Image Credit: www.penticton.ca

After council finishes deliberating the budget later in November, the spending plan will be finalized between December and January. Notices regarding tax rates will be issues to property owners in May or June.

The proposed budget includes some stats about Penticton – the average family has 2.6 members, the average age above the provincial and national average at 49, and the median income is below the provincial and national average at $54,219.

Numerous expenses contribute toward the city's budget.

Image Credit: www.penticton.ca

To contact a reporter for this story, email Dan Walton or call 250-488-3065 or email the editor. You can also submit photos, videos or news tips to the newsroom and be entered to win a monthly prize draw.

We welcome your comments and opinions on our stories but play nice. We won't censor or delete comments unless they contain off-topic statements or links, unnecessary vulgarity, false facts, spam or obviously fake profiles. If you have any concerns about what you see in comments, email the editor in the link above.

News from © iNFOnews, 2021