FILE PHOTO

(JENNIFER STAHN / iNFOnews.ca)

September 17, 2018 - 2:00 PM

KAMLOOPS - City staff are seeking Kamloops city council’s authorization to either approve or disapprove the applications from three community organizations that have requested a permissive property tax exemption.

The not-for-profit organizations include two supportive housing locations provided by ASK Wellness Society and the Kamloops Family Resources Society, according to a report prepared for city council’s regular meeting tomorrow, Sept. 18.

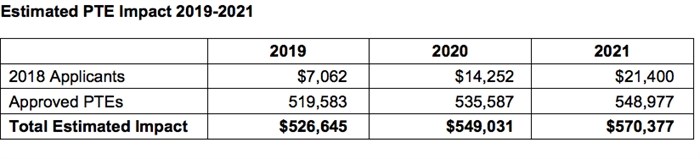

The report says there are currently 58 properties approved for either the full or phased-in permissive tax exemptions for the 2017 to 2021 cycle. The phased-in permissive tax exemption would increase by one-third each year until an organization receives a 100 per cent exemption by 2021, the report says.

“The city received three new applications for the 2019 to 2021 cycle, administration reviewed each application for not-for-profit organizations to ensure that the applicants met the council’s established eligibility for a phased-in exemption,” the report outlines.

ASK Wellness Society's Fountain Manor, which offers 24 units of supportive housing to individuals 50 years old or older and who have a history of homelessness, is one of the applicants. The affordable housing property is located at 506 Columbia St. and the municipal portion of the 2019 property taxes is estimated to be $6,200, which would be one-third exempt next year says the report.

Maverick Manor, located at 1250 Trans-Canada Highway West, is also run by ASK Wellness Society and provides 42 units of supportive housing to individuals with a history of homelessness. The municipal portion of the 2019 property taxes is estimated to be $11,200.

The Kamloops Family Resources Society at 657 Seymour St. has also applied for a tax exemption. The municipal portion of the 2019 property taxes is estimated to be $4,000. The registered society offers families in the community a wide variety of supportive programs such as parenting and health workshops, drop-in programs and recovery support for mothers with addictions.

The funding cap is set to $681,400 for 2019 and the estimated approved permissive tax exemptions including the three new applications total $570,377, according to the report.

Kamloops city council will hear the full report tomorrow, Sept. 18.

Permissive Tax Exemption Impact for 2019 to 2021 for Kamloops.

Image Credit: Contributed by City of Kamloops

To contact a reporter for this story, email Karen Edwards or call (250) 819-3723 or email the editor. You can also submit photos, videos or news tips to the newsroom and be entered to win a monthly prize draw.

We welcome your comments and opinions on our stories but play nice. We won't censor or delete comments unless they contain off-topic statements or links, unnecessary vulgarity, false facts, spam or obviously fake profiles. If you have any concerns about what you see in comments, email the editor in the link above.

News from © iNFOnews, 2018