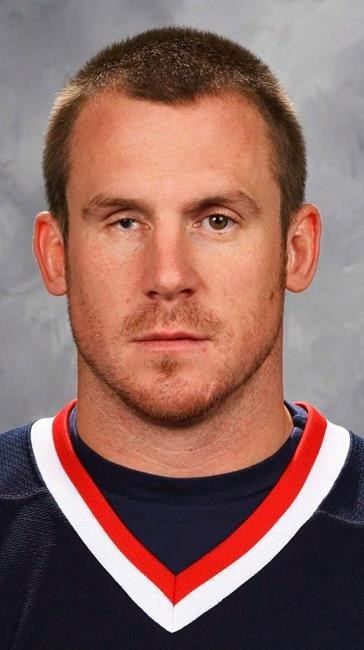

Columbus Blue Jackets hockey defenceman Bryan Berard is shown in a 2005 file photo. When Berard retired in 2009, he was shocked to learn that the nest egg he built over a 10-year NHL career was gone. He'd been duped out of $3 million. THE CANADIAN PRESS/AP/The Columbus Dispatch ** NO SALES **

June 28, 2016 - 8:03 AM

When Bryan Berard retired in 2009, he was shocked to learn that the nest egg he built over a 10-year NHL career was gone.

He'd been duped out of $3 million.

He was angry, not only at the two men eventually convicted for squandering his money, but at himself for letting it all happen. Berard was one of a number of former NHL players defrauded by Phil Kenner and Tommy Constantine, who were convicted in the U.S. last summer on charges of wire fraud, conspiracy and money laundering.

Living more modestly these days, the 39-year-old former defenceman is trying to make sure other players don't make the same mistakes. In his role as director of sports and entertainment for Whale Rock Point Partners, a financial consulting firm, Berard doesn't offer financial advice but steers players in that direction.

"For me, I thought the best thing was to talk about it, let people know what happened to me," Berard said in an interview. "You hate to say it, but there's just a lot of bad people out there that really, when it comes to money they really don't (care) who they step on or what damage they cause."

Berard, a former first overall draft pick who played for six different NHL teams, has also spoken at the NHL's rookie orientation on the subject of financial management. He shows players how long the money made from a short career has to last and how it's far less than they might think after taxes and other fees. He advises against enticing, but risky investments like restaurants or real estate.

His best advice though is research, research, research. Ask questions about the strategy of the people handling the money and their background, he says.

Berard didn't ask those questions. He knew the cheques were rolling in, but paid little attention to where the money was going. He figured the people he trusted would take care of those things.

"Most of the hockey players come from blue-collar families like I did. My parents knew nothing about investing; my parents didn't have any money to invest," said Berard, a native of Woonsocket, R.I. "We did trust somebody and obviously trusted the wrong person, but that's where the younger kids today really need to ask questions and hopefully get steered in the right direction."

Berard would eventually learn the people he trusted were using his money and that of other players for fraudulent purposes, including real estate deals that were fake or just bad investments. Berard started combing through his finances after retiring and, with the help of a retired police officer who had also been duped, unravelled the mess.

Kenner and Constantine were charged in late 2013 after an investigation by the FBI and IRS.

Scams like the one Berard fell victim to are not uncommon. Just last week, the NLF Players' Association indefinitely suspended the registration of a financial adviser accused of cheating several professional athletes, include NFL quarterback Mark Sanchez, out of millions of dollars in a Ponzi-like scheme.

Berard is trying to get his story out, not simply for the sake of his firm but to ensure that more players aren't left scrambling when they retire.

He travelled to Buffalo for last week's NHL draft in hopes of connecting with prospects who will soon sign their first NHL deals.

"To play in the NHL or playing any sports, it's a quick career, even if you're playing 15 years," said Berard. "The money could be over with in a few years so you really need to create good spending habits and really understand you want to make the money last."

A few years after his retirement, Berard was approached by Brad Dorman and Rich Cavanagh, two family friends and founding partners of Whale Rock.

The pair, both former Harvard hockey players, heard about Berard's story and wanted to know if he'd like to help prevent it from happening to others. Berard has worked with the firm since 2013.

"It takes a lot of moral strength and character to tell the world you screwed up," Dorman said via email. "He does it because he loves the sport and doesn't want to see these kids get taken advantage of like he did."

The NHL and the NHLPA conduct a rookie orientation each summer, which includes education on financial planning and wealth management. The players' association also meets with players early in each season to reinforce some of those concepts.

Investment advice is not included though, nor does the PA certify financial advisers.

Berard just wants to help others understand where he went wrong.

"That's where I'm hoping that I can make a difference with the players," he said.

News from © The Canadian Press, 2016