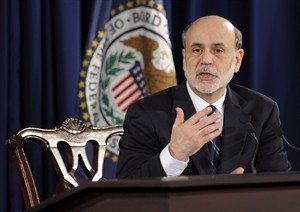

US Federal Reserve Chairman Ben Bernanke in Washington, April 25, 2012. THE CANADIAN PRESS/AP, Susan Walsh

July 17, 2012 - 8:17 AM

TORONTO - The Toronto stock market was set for a higher open Tuesday as traders looked to a speech later in the morning by U.S. Federal Reserve chairman Ben Bernanke and a scheduled interest rate announcement by the Bank of Canada.

Traders also took in major dealmaking. Quebec aerospace manufacturer Heroux-Devtek Inc. (TSX:HRX) is selling about one-third of its business for $300 million in cash. The deal affects Heroux-Devtek locations in Dorval near Montreal, Mexico, Texas and Ohio.

The Canadian dollar was off 0.02 of a cent to 98.53 cents US ahead of the central bank announcement (at 9 a.m. EDT). Analysts say the bank will keep its key rate unchanged at one per cent, reflecting a general slowing in global economic conditions.

U.S. futures advanced ahead of the Fed chairman's speech. It is hoped Bernanke will signal another round of stimulus, in the form of bond purchases, is in the offing. A third round of quantitative easing would seek to push down long-term interest rates and encourage more borrowing and spending. The first two rounds triggered powerful rallies in the U.S. stock market.

The Dow Jones industrial futures gained 55 points to 12,703, the Nasdaq futures ran ahead 11.75 points to 2,583.25 and the S&P 500 futures rose six points to 1,353.4.

Central banks in China, Europe and Britain have responded to slowing growth recently through a combination of cutting interest rates, easing lending requirements and buying bonds.

In particular, it is hoped China, the world’s second-largest economy, will provide further relief after second-quarter annual growth fell to a three-year low of 7.6 per cent.

Expectations of a further stimulus in China have risen after Premier Wen Jiabao’s weekend promise of tax breaks and other aid to struggling small businesses.

Worries about slowing conditions grew Monday as data showed U.S. retail sales fell in June for the third straight month. Also, the International Monetary Fund shaved its estimate for global growth for this year and next. And the IMF warned that Europe’s financial crisis and a potential budget crisis in the United States could slow world growth even further next year.

The TSX could find support from the energy sector as oil prices continued to advance with the August crude contract on the New York Mercantile Exchange ahead 43 cents to US$88.86.

Copper advanced a penny to US$3.49 a pound while bullion gained $1.10 to US$1,592.70 an ounce.

European bourses were mixed as a key measure of German investor confidence fell unexpectedly in July.

The ZEW institute said Tuesday its index fell for the third month in a row to minus 19.6 points from minus 16.9 in June. Market analysts foresaw a small increase to minus 15.0.

German economic indicators have worsened recently as the financial turmoil heightened economic uncertainty among other eurozone members, who are also Germany’s main trade partners.

London's FTSE 100 index declined 0.36 per cent. Frankfurt's DAX gained 0.43 per cent while the Paris CAC 40 was up 0.53 per cent.

Earlier in Asia, Japan’s Nikkei 225 closed 0.4 per cent higher, China’s Shanghai Composite Index gained 0.6 per cent, South Korea’s Kospi added 0.2 per cent and Hong Kong’s Hang Seng jumped 1.8 per cent.

Traders also looked to another series of earnings from corporate America.

New York bank Goldman Sachs says its net income fell 11 per cent to US$962 million or $1.78 a share in the April-to-June period after the investment bank’s clients traded less and made fewer deals as global financial markets turned volatile. That’s far more than the $1.17 per share that analysts were expecting. Revenue also beat forecasts, even as it declined nine per cent to $6.63 billion.

Mattel Inc.’s second-quarter net income climbed 20 per cent to US$96.2 million or 28 cents a share, beating estimates by eight cents. Sales of Hot Wheels, Barbie and Monster High products increased and the company’s sales costs and advertising and promotional spending declined.

Coca-Cola Co.’s second-quarter net income fell slightly from a year ago to US$2.79 billion or $1.21 a share, beating expectations by two cents. Revenue reached $13.09 billion from $12.74 billion.

News from © The Canadian Press, 2012