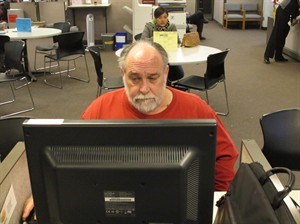

FILE - In this hursday Dec. 26, 2013 file photo, Richard Mattos, 59, looks for jobs at a state-run employment center in Salem, Ore. The Labor Department reports on the number of Americans who applied for unemployment benefits last for the last week of 2013 on Thursday, Jan. 2, 2014. (AP Photo/Jonathan J. Cooper, File)

January 02, 2014 - 8:40 AM

NEW YORK, N.Y. - The U.S. stock market got 2014 off to a weak start Thursday. Major indexes fell after ending last year at record levels. Trading has been quiet this week with many investors on vacation.

KEEPING SCORE: The Dow Jones industrial average fell 80 points, or 0.5 per cent, to 16,496 as of 11:24 a.m. (1624 GMT). The Standard & Poor's 500 index dropped 10 points, or 0.6 per cent, to 1,837. The Nasdaq composite fell 26 points, or 0.6 per cent, to 4,150.

TECH TROUBLES: Technology stocks fell the most. Analog Devices lost $1.50, or 2.9 per cent, to $49.43 after analysts at Goldman Sachs advised its clients to sell the stock, saying it's overvalued compared to its peers. Apple fell $7.62, or 1.4 per cent, to $553.51, after Wells Fargo cut its outlook on the stock to "market perform" from "outperform," saying the company's profit margins may come under pressure later this year.

JOBS: The number of Americans seeking unemployment benefits last week fell by 2,000, extending a recovery in the job market. The Labor Department reported Thursday that the four-week average of claims rose 8,500 to 357,250. The average was driven up by spikes that reflected seasonal volatility around the Thanksgiving and Christmas holidays.

HEAD START ON 2014: Stocks opened the year at lofty heights. The S&P 500 recorded its best year since 1997 last year; The Dow rose the most since 1995. The Nasdaq did far better than the Dow and S&P 500, rising 38.3 per cent for the year, its best year since 2009.

TREASURYS: The yield on the 10 year Treasury note climbed to 3 per cent from 2.97 per cent. The yield on the note is close to its highest since July 2011.

M&M: Macy's and Martha Stewart Living Omnimedia have announced an end to their bitter standoff over a breach-of-contract lawsuit involving J.C. Penney. Stewart's company and Penney signed a merchandising deal in December 2011. That prompted Macy's to sue both companies for violating its exclusive agreement with Martha Stewart. Terms of the settlement are not being released.

Macy was unchanged at $53.41. Martha Stewart Living rose 18 cents, or 4.3 per cent, to $4.38.

BACK NEXT WEEK: Many investors are away this week and trading volume is expected to continue to be thin. The weekly unemployment claims numbers released Thursday are getting a lot of attention because the December employment report due out next week.

SO GOES JANUARY: Investors will be watching how the market does in January since that can suggest how the rest of the year might turn out. The barometer has proven accurate almost 90 per cent of years since 1950, according to the Stock Trader's Almanac.

News from © The Associated Press, 2014