Banking on a housing market crash? You're not alone

If you were banking on what housing market experts said about the real estate last year, you may have lost out. Predicted plummeting prices didn’t pan out and the average home price across Canada rose by 25 per cent.

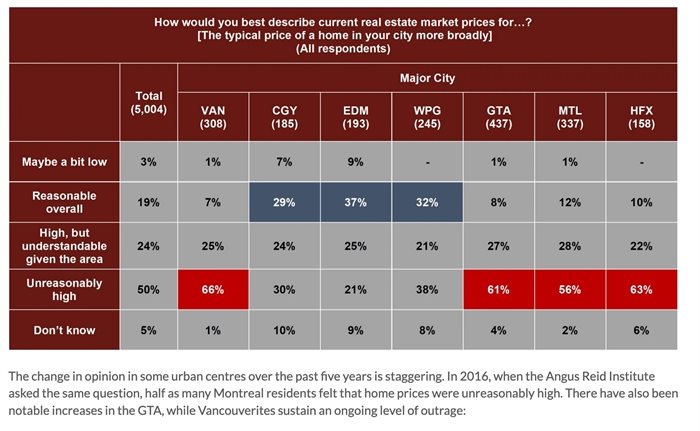

A new study from the non-profit Angus Reid Institute tapped into how people are feeling about this strange market and what they want to see going forward.

Among other things, the institute found 40 per cent of Canadians hopeful that housing prices would continue to escalate, while 39 per cent are banking on a fall.

One-in-five would like to see the average home price drop by 30 per cent or more.

“Notwithstanding the staggering knock-on effects of a housing crash of such magnitude on almost every other aspect of the Canadian economy, it is an undeniable indicator of the amount of housing pain people in this country are experiencing coast to coast, in large communities and small,” Angus Reid survey report reads.

Additionally, three-in-five rural dwellers say housing prices in their community are too high, alongside 67% of those who live in small cities. These levels rise above seven-in-ten among urban and suburban Canadians.

Given these sentiments, the Angus Reid Institute researchers collated data into a Housing Pain Index to understand the experiences and trials of Canadians who are either priced out or trying to maintain the value of their investments.

Of note, the survey found of people who didn’t town a home, only one-in-five (21%) do not want one, while 45 per cent say they would like to but can’t afford it right now, while one-quarter (25%) say they would like to but doubt they’ll ever afford it.

To contact a reporter for this story, email Kathy Michaels or call 250-718-0428 or email the editor. You can also submit photos, videos or news tips to the newsroom and be entered to win a monthly prize draw.

We welcome your comments and opinions on our stories but play nice. We won't censor or delete comments unless they contain off-topic statements or links, unnecessary vulgarity, false facts, spam or obviously fake profiles. If you have any concerns about what you see in comments, email the editor in the link above.