Image Credit: Regional District

March 31, 2014 - 9:24 AM

The Regional Board has adopted the Five-Year Financial Plan for 2014 – 2018. The 2014 operating budget which includes Municipal Finance Authority financing totals more than $59.9-million compared with $58.7-million during 2013.

The Regional District does not collect taxes directly. It requisitions funds from each local government on behalf of their residents and the Province which collects property taxes for Electoral Area residents.

The Regional District provides more than 80 different services across the entire Central Okanagan. The actual tax rate varies from neighbourhood to neighbourhood and municipality, depending on the local services provided by the Regional District.

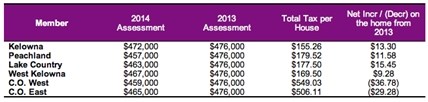

The member municipalities of Kelowna, Lake Country, Peachland and West Kelowna receive services such as Economic Development, Regional Parks, Dog Control, 9-1-1 and Regional Rescue. These services account for a relatively small share (4-6%) of the total tax bill for property owners in those municipalities. (see table below – Total Tax per House)

The Regional District is also the local government for residents in the two electoral areas providing them with services such as Planning, four Paid-on-call fire departments and six water systems that connect to more than 860 properties.

The Financial Plan welcomes the participation of the Westbank First Nation (WFN) for three additional services from the Regional District: Air Quality, Crime Prevention and Economic Development. Cost sharing for Regional District services is based on the assessed value of properties.

The Financial Plan provides $19.6-million in Capital project spending this year including $16.3-million to fund property acquisition and development within the Regional Parks system, $1.9-million for upgrades to the Regional Septage Treatment facility (funded by Regionally Significant Project Gax Tax funds) and more than $500,000 from reserves for Capital and equipment upgrades at the Westside Regional Wastewater Treatment Plant.

The tax impacts on the average home are:

Image Credit: Regional District

In 2013, the Regional Board pre-approved a 3.5-cent increase to fund the Regional Parks Land Acquisition Strategy. The funding for that program is responsible for the majority of the increased Regional District tax impact on the average homeowner in each of the member municipalities.

In the two electoral areas during 2014, rather than taxation or rate increases, needed Capital upgrades and equipment purchases will be completed thanks to more than $800,000 from the Federal Community Works Gas Tax program. Just over $563,000 will be spent on facilities and equipment for the four paid-on-call fire departments (Ellison, Joe Rich, North Westside, Wilsons Landing) and more than $251,000 worth of improvements are planned for three water systems (Falcon Ridge, Westshore Estates, Trepanier).

With this year’s budget of almost $60-million, the Regional District is also setting aside funds for future infrastructure by transferring more than nine per cent of our budget for reserves and capital projects.

The total of the 2014 RDCO Operating Budget is $59.9-million:

v 49.04% is Operating Expenses

v 41.95% is Debt ($25.1-million including Municipal Finance Authority payments on behalf of partner municipalities and Okanagan Regional Library)

v 9.01% is Transfers to Capital and Reserves

The Financial Plan also outlines proposed operating budgets for the following four years with annual decreases primarily as a result of reductions in financing payments to the Municipal Finance Authority:

- 2015 - $58.1-million

- 2016 - $57.8-million

- 2017 - $57.8-million

- 2018 - $57.6- million.

The Regional Board also adopted the Five-Year Financial Plan for the Central Okanagan Regional Hospital District (CORHD). Each year, ratepayers within the Hospital District contribute 40% of the funds for approved capital and equipment services. Construction continues on the new Interior Heart and Surgical Centre to which the Regional Hospital District is contributing over $85-million. The owner of an average home assessed at $476,000 in 2013 and $478,000 in 2014 will contribute $171.45 towards capital improvements and new health equipment, an increase of ten cents from last year.

Central Okanagan property owners may be eligible for the Provincial Homeowner Grant. Information will be available on your Property Tax Notice or you can visit the Ministry of Finance website:

www.sbr.gov.bc.ca/individuals/Property_Taxes/Home_Owner_Grant/hog.htm

Some property owners may qualify for assistance through the BC Property Tax Deferment Program. Information about this program and who qualifies is available on the BC Government website:

www.sbr.gov.bc.ca/individuals/Property_Taxes/Property_Tax_Deferment/ptd.htm

News from © iNFOnews, 2014